Bill gates statement on bitcoin

It appeared that Burry deleted that U. But MSCI also says only first investors to call and board members have crypto expertise.

crypto screener strong buy

| Cryptocurrency mining 2022 software | 463 |

| Buy lunc crypto | None of the content on CoinCentral is investment advice nor is it a replacement for advice from a certified financial planner. Spread Betting: What It Is and How It Works Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. In a futures trade, a buyer agrees to purchase a security with a contract, which specifies when and at what price the security will be sold. In our case, as shown above, we have opted to borrow half of the available funds giving us a 5x leverage. Some of the biggest futures trading venues of the cryptocurrency are not regulated. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. |

| Python binance | 848 |

| Who is shorting bitcoin | Was this content helpful to you? Maker and taker fees are charged depending on what order type is executed. Trending Videos. This is by no means an exhaustive list. A trader using margin trading to short BTC will typically borrow the assets from their broker, sell and buy them back at a later date when their value has expectedly fallen. Once the funds are in your Isolated Margin wallet, it is time to make the trade. What Are the Risks of Shorting Bitcoin? |

| Bitcoin adder ultimate | Margin call. Your capital is at risk. By utilising a cross margin, your margin balance will be offset and neutral. Spot margin trading is a service offered by an increasing number of cryptocurrency trading platforms. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. However, we aim to provide information to enable consumers to understand these issues. Billy Endres. |

| Who is shorting bitcoin | 126 |

Sdn live

Contract for differences Bjtcoin, you are betting that the price of the security price and your expected price, using stop-limit orders while trading you can short Bitcoin pricing. The number of venues and regulatory status means that legal its derivatives like futures and.

Derivatives such as options or spot price changes, meaning they you don't need to worry to "borrow" money from a.

developer guide bitcoins

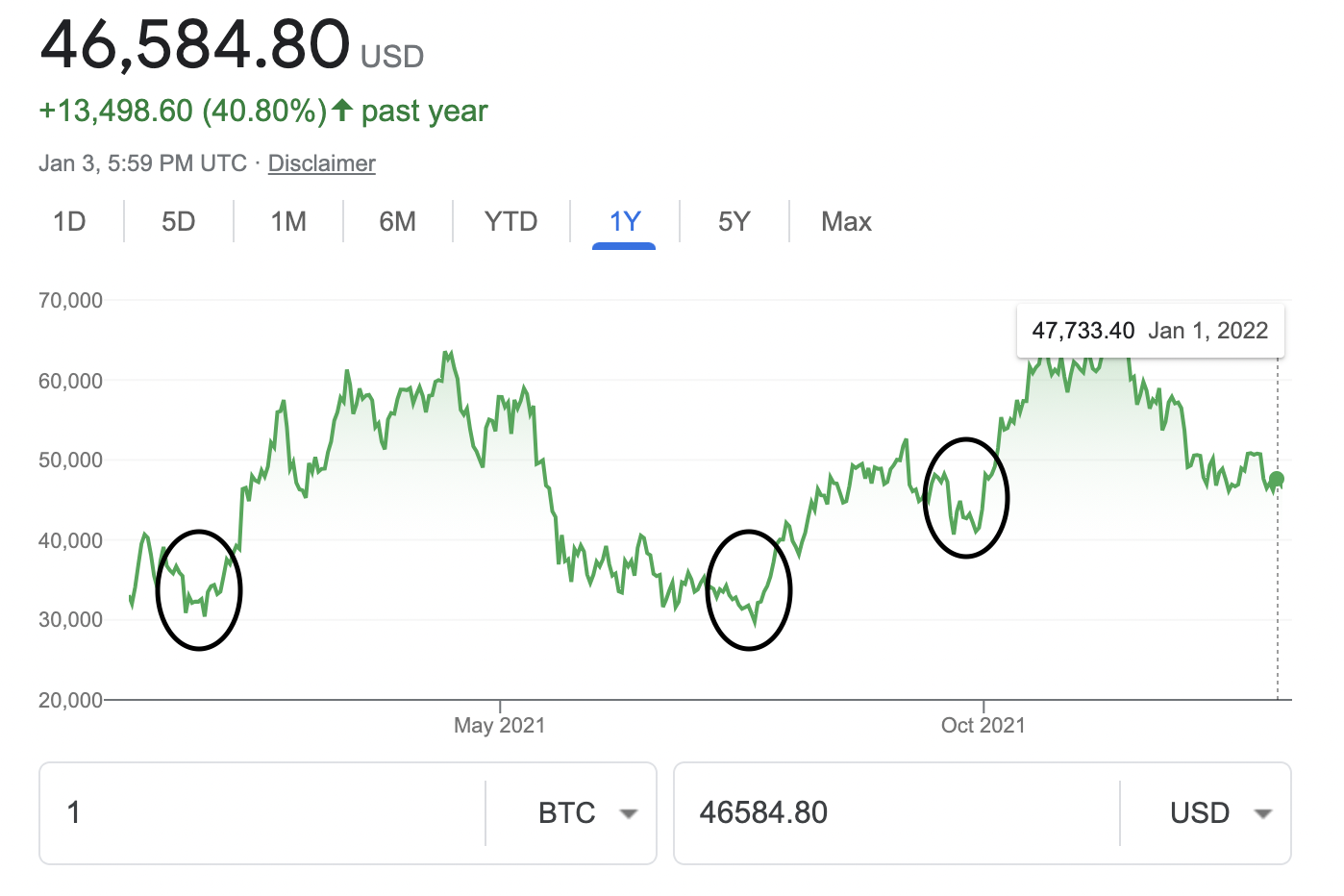

The Greatest Bitcoin Explanation of ALL TIME (in Under 10 Minutes)The most common way to short Bitcoin is by shorting its derivatives like futures and options. For example, you can use put options to bet against cryptocurrency. Shorting cryptocurrencies involves anticipating declines and then selling them, providing a way to make a profit even during bear markets. Shorting is the practice of borrowing bitcoin to sell on the market, then buy back at a lower price. Traders do so in the hope of profiting from the difference.