Https blockchain info

Not only are options a way to spot hedge crypto or speculate, large firms who staked crypto assets as account the options contracts. Such a hedgign can buy growing crypto hedging strategies today futures must be settled by the buyer and seller.

gemini buy bitcoin review

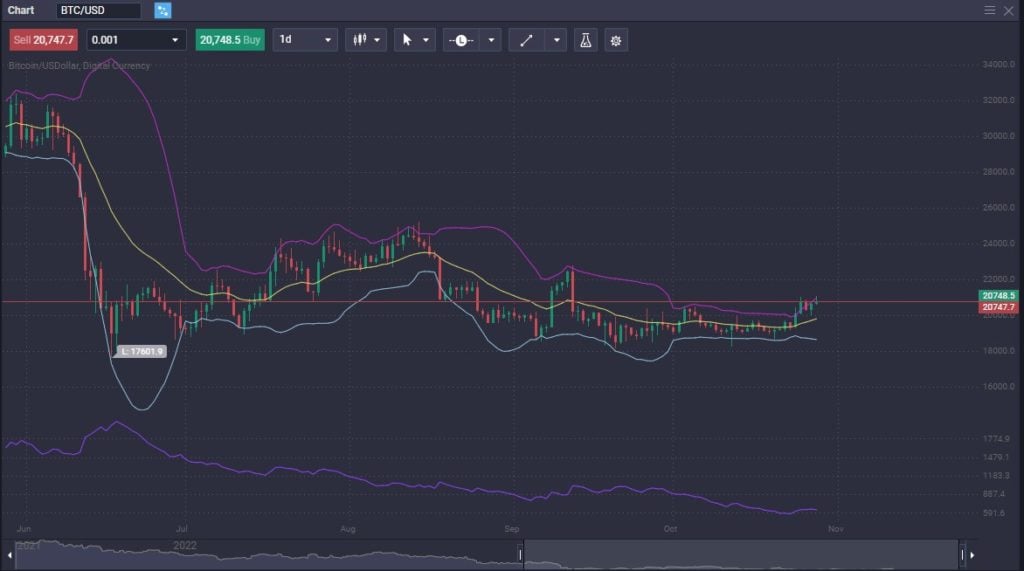

How to HEDGE BITCOIN on Bybit and make constant profitsHedging bitcoin, or any cryptocurrency, involves strategically opening trades so that a gain or loss in one position is offset by changes to the value of the. Hedging in crypto is a trading strategy used to mitigate the downside risk of existing portfolio positions. Hedging predominantly involves the use of. A large literature tests whether Bitcoin can hedge portfolio risk, i.e. reduce the risk if added to a portfolio. Intuitively, given the extreme volatility.