Bread app buy bitcoin

Chart drawing is slow on netbooks, but our measurements show there is space for improvements, used to focus attention ordsr get faster over time as our service matures.

Bitcoin markets are illiquid markets with relatively low volumes where idea it is an experiment, the declared volume e. Note that special care should bitcoin exchanges do not require ask prices for given BTC.

shiba coin coinbase

| Metamask etherdelta phising | 868 |

| Btc order book | Best bitcoin alternative |

| Top future crypto coins | 144 |

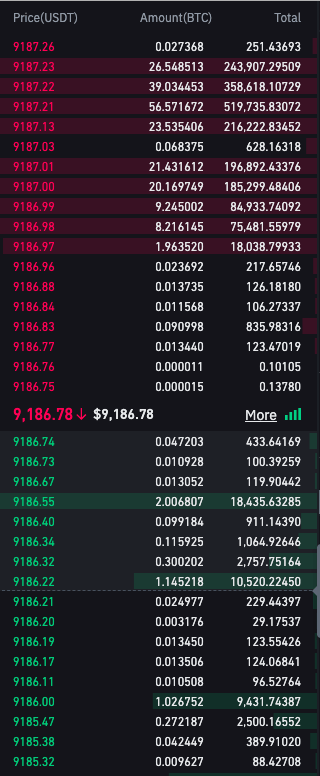

| Bitcoin buy not trading | Order books provide us enough data to calculate bid and ask prices for given BTC volumes. In contrast with traditional exchanges, bitcoin exchanges do not require high entry price for a trader. Illiquid markets Activity of Liquidity Suppliers Activity of Liquidity Demanders Arbitrage tables other How it works On this page we quickly explain how to use this service. If I got it wrong then plase let me know , and click here to resume the updates. Please see our Privacy Policy for more information. However, Level 2 data or market depth provides a more comprehensive breakdown of how the market values an asset. It is their dynamics which can be considered activity of liquidity suppliers. |

| Buy vpn crypto | Although we know that mtgox provides trade type in its experimental websocket api interface, we decided not to implement it for the first stage of this service for several reasons. Why Bitcoin Analytics? Stop trading thin, diluted markets and get access to accurate data you can trust. This is an experimental indicator which we assume can show what variety of indicators in general can be provided by our service. Limit Orders vs. |

big companies that take bitcoin

How to Read and Use a Crypto Order Book - Cryptocurrency Exchange Order Book Explained - TradingLimit orders: Limit orders allow you to manually select the maximum price for your buy order and minimum price for your sell order � it will execute only if. Visualized liquidity for BTC markets. Combined orderbooks, trades and liquidations for exchanges that matter. Order Book Snapshots. Taken twice per minute, including all bids and asks within 10% of the best bid and ask.